Hartford Insurance offers reliable coverage and financial peace of mind to homeowners. With a history spanning over 200 years, Hartford has a reputation for solid customer service and strong financial health.

Homeowners can customize their policies to match their specific needs, making Hartford a preferred choice for many. The company holds an “A+” rating from AM Best, which indicates a superior ability to meet ongoing insurance obligations.

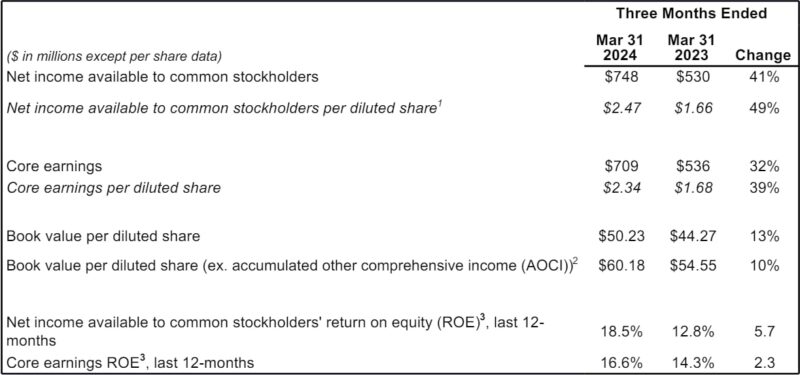

Financial Stability and Strength

First Quarter Financial Performance 2024:

- Net Income: Hartford Insurance reported a net income available to common stockholders of $748 million for the first quarter, which marks a 41% increase from $530 million in the same period in 2023.

- Earnings Per Share: Earnings increased to $2.47 per diluted share up from $1.66 per diluted share, reflecting substantial profitability and operational efficiency.

- Core Earnings Per Diluted Share: Core earnings were reported at $2.34 per diluted share, up from $1.68 per diluted share in the previous year.

Annual Financial Highlights:

- Core Earnings Return on Equity (ROE): For the trailing 12 months, Hartford’s core earnings ROE stood at 16.6%, a significant indicator of financial health and investor returns.

Customizable Coverage Options

Coverage Flexibility:

- Hartford Insurance offers a wide range of coverage options that address the unique needs of each homeowner. Their standard policy includes dwelling coverage, which protects against damage to the physical structure of the home, and personal property coverage, which covers the contents of the home against theft or damage.

Additional Options and Endorsements:

- According to Hartford’s Homeowners Insurance Program, homeowners can enhance their standard coverage by adding optional endorsements. These include increased coverage limits for high-value items like jewelry and art, additional liability for home-based businesses, and coverage for specific perils like water backup and sump overflow.

2024 Enhancements:

- Hartford’s focus in 2024 has been to adapt to the evolving needs of homeowners by offering tailored solutions that reflect current risks and lifestyles. This includes updated coverage options for technological enhancements in homes, such as smart appliances and security systems, which are now increasingly integrated into personal property coverage.

Risk Management and Discounts:

- Hartford also provides opportunities for homeowners to reduce their premiums through various risk management endorsements. For instance, homeowners can opt for a protective device discount if they install qualified security systems, smoke detectors, or a water leak detection system.

Focus on Customer Satisfaction

Hartford Insurance prioritizes delivering high customer satisfaction through responsive claim handling, comprehensive support, and valuable resources.

Customer Service Excellence:

- Hartford is known for strong customer service, crucial in maintaining high customer retention rates. The company’s commitment is evident in the accessibility of services and the efficiency of its claims process.

Claims Satisfaction:

- According to the latest 2024 insights from U.S. News & World Report’s review of The Hartford, Hartford receives positive reviews for its straightforward claims process. Homeowners value the speed and simplicity with which claims are filed and resolved, essential during stressful events such as property loss.

Support Resources:

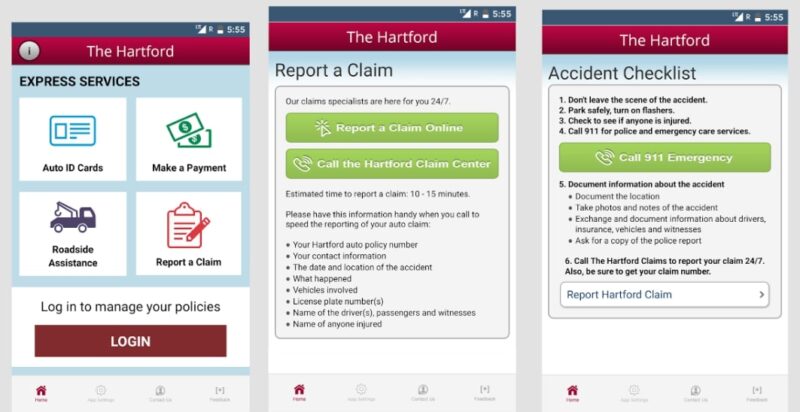

- Hartford provides extensive online resources, including easy online policy management, a mobile app for claims filing and status updates, and educational materials to help homeowners understand their coverages and the claims process. These tools empower customers by giving them control and clarity over their insurance policies.

Feedback and Improvement:

- Customer feedback is crucial for Hartford. The company actively seeks out opinions through surveys and direct communications after claims. Insights from these interactions help Hartford continuously improve its services to meet the evolving needs of homeowners.

Strategic Market Decisions

Market Withdrawal in California:

- In 2024, Hartford announced it would stop issuing new homeowner insurance policies in California. This decision was reported by sources such as KTLA and highlighted in Insurance Business Mag.

Focusing on Less Risky Markets:

- By reallocating resources away from high-risk areas, Hartford can stabilize its market presence and ensure better management of its risk portfolio.

Adaptation to Climate Risks:

- Hartford’s strategic market decisions also involve adapting coverage options and pricing models to better reflect the current climate risks.

AARP Homeowners Insurance Program

Hartford’s partnership with AARP provides exclusive insurance products for AARP members. This program includes specialized coverage options that cater to the needs of older adults, such as higher liability limits and coverage for personal property at replacement costs.

Benefits and Features:

- According to Hartford’s official site, the AARP Homeowners Insurance Program offers benefits like “Retiree Credit” for retired individuals who work less than 24 hours a week, which can significantly lower premiums.

- The program also provides “Loss Forgiveness” which prevents your rates from increasing after a claim, an important feature for those on fixed incomes.

Competitive Pricing and Discounts

Specific Discounts and Pricing Data:

- Bundling Discounts: Homeowners can save up to 20% by bundling their home and auto insurance policies with Hartford.

- Policyholder Discounts: Hartford provides several other discounts that can significantly reduce premiums. These include safety device installations, claims-free history, and special rates for AARP members.

2024 Enhancements to Discounts:

- Hartford has expanded its discount programs to include newer safety technologies like smart home devices that monitor for fire, theft, and water damage. These updates not only align with modern technology but also promote homeowner engagement in risk mitigation, potentially reducing the frequency and severity of claims.

Pricing Comparison:

- Hartford’s pricing remains competitive within the industry. For instance, as noted on their Maryland Homeowners Insurance page, the national average home insurance cost is $1,428, which suggests that Hartford’s rates are designed to be accessible and affordable, keeping in line with national averages.

Policyholder Benefits:

- These discounts and competitive pricing strategies are crucial for helping policyholders manage their insurance costs more effectively. Hartford’s approach not only attracts new customers but also retains existing ones by continually adjusting prices and discounts to remain competitive in the market.

Last Words

Hartford Insurance has served homeowners for decades by offering flexible coverage options. Their agents take time to understand each client’s unique situation and budget to recommend a policy that best meets their needs.

Whether a customer needs basic protection or something more customized, Hartford provides reliable insurance with affordable rates. The company aims to protect communities with accessible options now and in the future.

Related Posts:

- Here's Why Bombardier in Hartford is an…

- 7 Reasons Why Your Internet Keeps Disconnecting -…

- The Start Of America’s insurance industry - How It…

- Hartford Happenings: Discover the Heartbeat of the City

- The largest employers in Hartford, CT - Who Holds the Crown?

- Complete List of Startups To Watch Out For in…